A tax-deductible donation must meet certain criteria to qualify and count against your taxes. See if a donation is deductible and if it will lower your tax bill.

Is my donation tax-deductible? If you’re a US taxpayer giving to a nonprofit or charity, you should be asking this question.

The short answer: It depends on who you donate to, and may depend on how much you give overall. Also, the answer is slightly different depending on whether you’re donating as an individual or as a business.

This guide will provide you with general information about tax deductions in the United States for 2023. Since everyone’s situation is different, always consult a financial advisor for advice specific to your tax situation and state.

Let’s go through the basics.

Is My Donation Tax-Deductible?

Will My Donations Reduce My Tax Bill?

Is My Business Allowed to Deduct?

What Does “Tax-Deductible” Mean?

If you know that your itemized deductions will exceed your standard deduction, tax-deductible charitable donations could lower your tax bill.

(If you aren’t sure what we mean by “itemized deductions” and “standard deductions,” see “Will My Donations Reduce My Tax Bill?“)

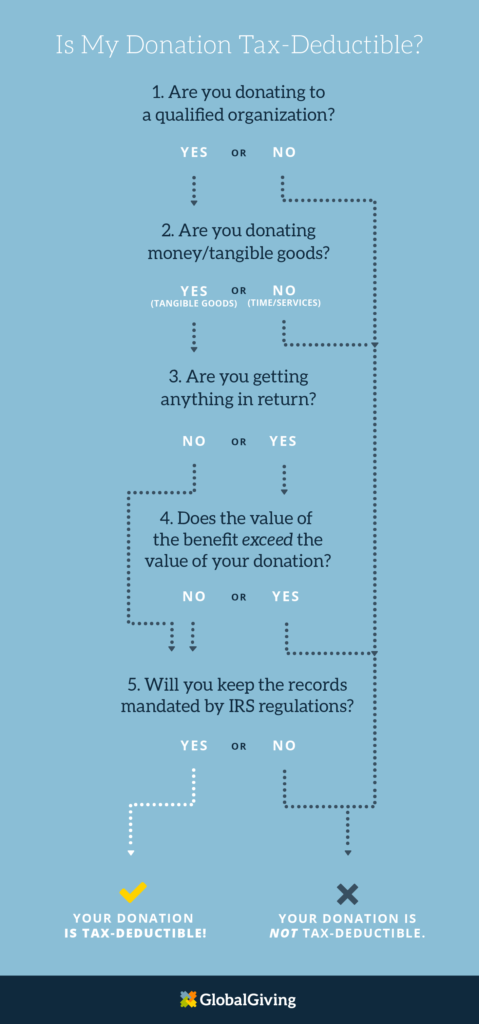

Let’s look at four key things that make a donation tax-deductible:

Anyone can accept a donation. For the donation to be tax-deductible, the group you give to must be what the IRS calls a “qualified organization.”

Only certain types of organizations get the IRS’s approval to declare that donations are tax-deductible. Most of these organizations have what’s called 501(c)(3) status.

Common examples include:

All qualified organizations will be able to provide a National Taxonomy of Exempt Entities, or NTEE, code, which is used to classify organizations based on the type of work they do. Qualified organizations will also show up in the IRS Nonprofit Lookup.

Some types of donations, even though they may be for worthy causes, are not eligible for tax-deductible donations. Common examples include:

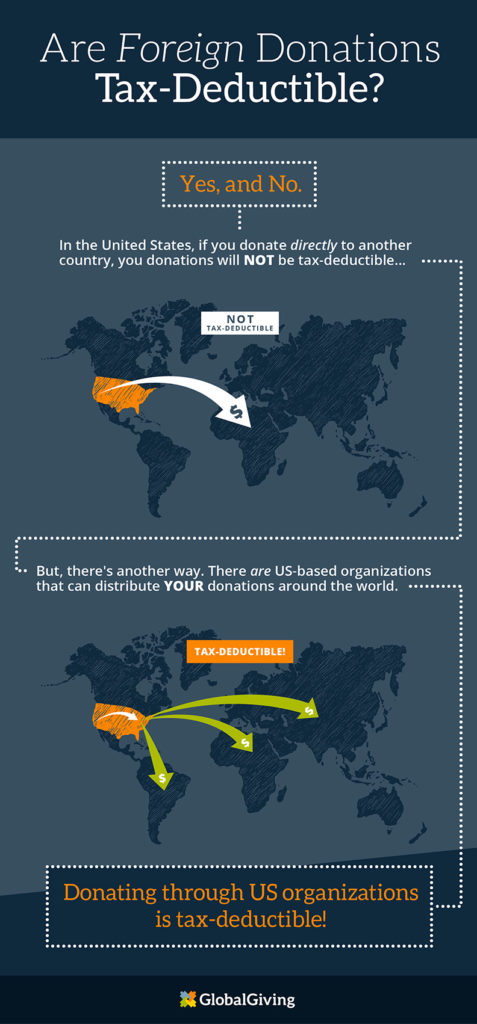

Another non-qualifying group is foreign charities (with a few, very rare exceptions). Even though there is a great need for charitable actions around the world, only donations to US-based organizations are tax-deductible for US taxpayers.

But there is another way to achieve tax deductibility for such giving: Some registered US organizations are allowed to distribute donations around the world. GlobalGiving, for example, is a registered 501(c)(3) organization that can make grants to nonprofits in other countries.

While your direct donation to a foreign organization isn’t tax-deductible in the US, you can donate to your favorite causes through GlobalGiving. We’ll make sure the money gets to Fiji, Guatemala, or the part of the world that you’re passionate about—and that you get the tax benefits you deserve.

Monetary donations to qualified organizations—whether by cash, check, credit card, or payment app—are tax-deductible.

Donations of property are too. If you give property (like cars or clothing) to an eligible organization, you can claim the fair market value of the property as a tax deduction. Fair market value means what someone would pay for the object right now, not what you paid for it originally.

Special rules apply to donations of certain property, like cars. Before you donate anything valuable, meet with the organization first, and maybe even your tax advisor.

Donations of time, services, or labor are not tax-deductible, but if you incur expenses performing those services, they could be.

Say you’re an elite cosmetologist who volunteers to give makeovers during a fundraising event. You can’t deduct the $500 an hour you’d normally charge, but you can deduct the cost of the mascara you use. You can even deduct the cost of the gas it took to drive to the event (download IRS Publication 526 for more details).

Any benefits you receive back from the organization you donated to count against your deduction. For example, if you pay $500 for baseball tickets at a charity auction, and the face value of the tickets is $400, you can only claim $100 as a tax deduction.

Some benefits aren’t counted against your donation. The IRS permits eligible organizations to provide membership benefits. For instance, a museum that gives their members discounts on admission, parking, and in the gift shop. These don’t count against your tax deduction amount. Neither do “token items” of limited value. A free sticker or tote bag as a gift doesn’t need to be counted against your donation.

Sometimes the organization will indicate the value of the gift or benefit you received on the documentation they send you, if any. Ask if you aren’t sure.

The IRS has mandatory recordkeeping requirements for tax-deductible donations. If you don’t follow their guidelines, you can’t claim the donation on your taxes.

Cash contributions of any amount: You must have a record showing the donation (credit card statement, canceled check) or a receipt from the organization that accepted your donation.

Payroll deductions of any amount: You must have a pay stub from your employer or a pledge card from the organization.

Cash contributions of $250 or more: Special requirements pertain to donations of $250 or more. These requirements only apply to one-time donations that meet or exceed $250. So if you donated $50 to the same organization every month for a year, the requirement would not pertain to those donations even though your total annual contribution would be $600.

For these donations, you must obtain what the IRS calls “contemporaneous written acknowledgment” from the organization for any such donation. The “acknowledgment” must be written, it must state how much you gave and whether you received any benefit as a result of the donation, and it must be dated before the date you filed your taxes.

Non-cash contributions of any amount: You must get a receipt from the organization, which describes the property you donated. (An exception is allowed if getting a receipt isn’t practical, like if you drop clothes off at a donation bin.) You must also keep your own records indicating what the property was and how you determined its “fair market value.”

Non-cash contributions of $250 to $500: The IRS has special rules for donations of property valued at $250 or more. You must obtain “contemporaneous written acknowledgment” from the organization for any such donation. The “acknowledgment” must be written, it must describe the property you gave, and include the organization’s estimate of the value of any benefit you received due to your donation.

Non-cash contributions of $500 or more: The IRS has extensive rules for non-cash contributions of $500 or more. If you plan to claim such a donation, meet with the organization first and possibly your tax advisor, as well.

Out-of-pocket expenses of any amount: Keep receipts of these expenses in case you need to prove that they were related to your volunteer activities with a qualified organization. This isn’t a requirement to claim the expenses as a deduction, but it is smart to do so.

Out-of-pocket expenses of $250 or more: To claim such expenses, you must have records of the expense. You also must have an acknowledgment from the qualified organization stating a description of the services you provided, and whether you received additional benefits of any kind to reimburse you for those services.

Tip: When you donate on GlobalGiving, you can access your tax receipts at any time by logging into your account. In addition, GlobalGiving emails every donor an annual tax receipt on or around January 15 of each year to make your record keeping that much easier.

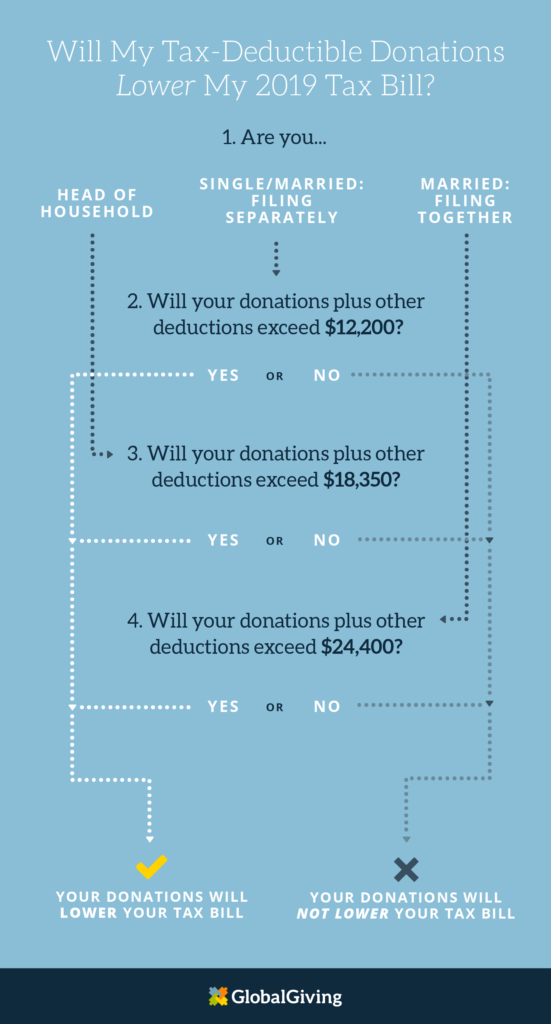

Everyone can (and should!) donate to nonprofits, but even if your donation qualifies as a tax-deductible contribution, you won’t necessarily see a lower tax bill.

Here’s why:

Every US taxpayer, or tax-paying household, is granted what’s called a “standard deduction.” Even if you don’t donate a penny to nonprofits, you can subtract the standard deduction from your income when calculating the tax owed.

The other category is “itemized deductions.” This includes charitable donations, qualified medical expenses, mortgage interest, and others. They are called “itemized deductions” because they are added up item by item then deducted from the total adjusted gross income (AGI) to reduce your potential tax bill.

When you calculate your taxes, your favorite tax software will help you identify what’s larger—your standard deduction, or your itemized deductions. Then you’ll subtract the larger amount from your income, and calculate your taxes from there.

For 2013, the standard deductions are as follows:

That’s a lot to deduct. If your itemized deductions (again, that’s charitable donations plus other deductions) add up to less than the standard deduction for your filing status, your donations won’t have any impact on your tax bill. For approximately 90% of taxpayers, the itemized deductions add up to less than their standard deduction.

Now, if your itemized deduction total was close to your standard deduction total, you might decide to make additional qualified donations that would make your itemized deduction amount higher. In that case, your donations, as well as any other additional deductions, would lower your tax bill.

The IRS also sets limits on how much of your income you can claim as tax-deductible contributions annually. This is only likely to apply if you are donating thousands of dollars to nonprofits, or have a very unusual tax situation. If so, it would be wise to talk things over with a tax advisor.

Whether a business is allowed to deduct a charitable contribution depends on the structure of the business and the type of donation.

Only businesses structured as a C-Corporations can deduct eligible charitable donations from their business income. If you are a corporate officer of a C-Corp or an employee of one, you should have an accountant who can advise you.

But don’t go away quite yet, all of you other business owners! Yes, those of you who are self-employed, LLCs, and S-Corps, we’re talking to you.

You are not allowed to claim charitable contributions as tax-deductible against your business income. You aren’t prohibited from donating under your business name, it’s just that donations will be counted as part of your personal itemized deductions. Any tax advantages will depend on whether you are eligible on your personal taxes.

However, there are ways you can get tax advantages and support nonprofits at the same time.

For example, say the local elementary school PTA is putting on a day of races and games. Everyone who participates will get a program listing the final results—along with a page of advertisements from local businesses who sponsor the event. If the kids or their parents are potential customers, that’s good advertising! The amount you pay for the advertisement would be fully deductible as a business expense.

Of course, there are limits. If the PTA only printed 100 programs, and you paid $10,000 for the advertisement, the IRS might deem that to be a “charitable contribution” rather than a business expense. The IRS has also stated that simply having your logo at an event doesn’t count as advertising.

It’s a gray area, so you should really read the full explanation on the IRS’s Advertising or Qualified Sponsorship Payment page, or talk to a tax advisor if you aren’t sure.

We the people, through our elected officials, have passed laws stipulating that if you spend money in certain ways, you may get a lower tax bill.

Some examples of what you might call “tax-efficient spending” include buying stocks for your retirement account, paying your mortgage, and, yes, donating to nonprofits.

The idea behind these laws is to encourage more people to save for retirement, buy homes, and support their communities.

“Tax-deductible” does not mean that you can deduct the amount you spend or give directly from your tax bill.

So if you have a $500 tax bill (lucky!) and make $500 worth of charitable donations, your tax bill will not be zero.

Rather, the “deduction” of tax deductibility happens on your income.

This example is an extreme over-simplification, but will serve to illustrate how tax deductions work:

In this way-too-basic example, both would pay the same amount of tax. Again, it would be more complicated in real life. So before you make a donation with the intent of gaining any tax advantages, see the “Will My Donations Reduce My Tax Bill?” section.

As you consider your giving plan for 2023 or 2024, consider reaching out to an established organization that can help you maximize your tax benefits. At GlobalGiving, all donations are tax-deductible, and you can choose from thousands of vetted organizations. You can explore key topics in our learning resources for donors, or contact us directly via email or phone.

Plan ahead, and you’ll do the most good for the world, and for your wallet.

Featured Photo: Re-train public school teachers in Nigeria by Bunmi Adedayo FoundationFind exactly what you're looking for in our Learn Library by searching for specific words or phrases related to the content you need.