It’s extremely rewarding to support causes you value, and that’s the main reason people give! But it’s natural to wonder if there can also be some tax benefits to your giving. This article answers the most common questions about charitable donation tax deductions in the US and beyond.

The Tax Cuts and Jobs Act of 2017 raised the standard deduction and simplified taxes for millions of households. This article answers the top questions related to tax deductions, including charitable donation tax deductions. This is for information purposes only and should not be considered tax advice.

Yes! Most Americans now opt for the standard deduction, which surpasses itemized tax deductions for most households.

If you expect your combined deductions to exceed the standard deduction, then it’s worth considering itemizing your taxes, including charitable donations. If you itemize, the charitable deduction limit is 60% of your adjusted gross income (AGI) for qualified cash donations and 30% of AGI for non-cash contributions made in 2023.

Lots of donors want to safely give to the causes that they care about internationally, including disasters, while also receiving the benefits of giving to a US-based charity. GlobalGiving makes that possible. We have thousands of vetted nonprofit partners all over the world (170 countries and counting) doing everything from reforesting the Amazon to providing care for adults with disabilities.

Hang on to your thank you or acknowledgment emails/letters from organizations you support. Alternatively, many nonprofit organizations, including GlobalGiving, send a year-end giving summary to donors.

The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill. Here’s what that number is for households in 2023:

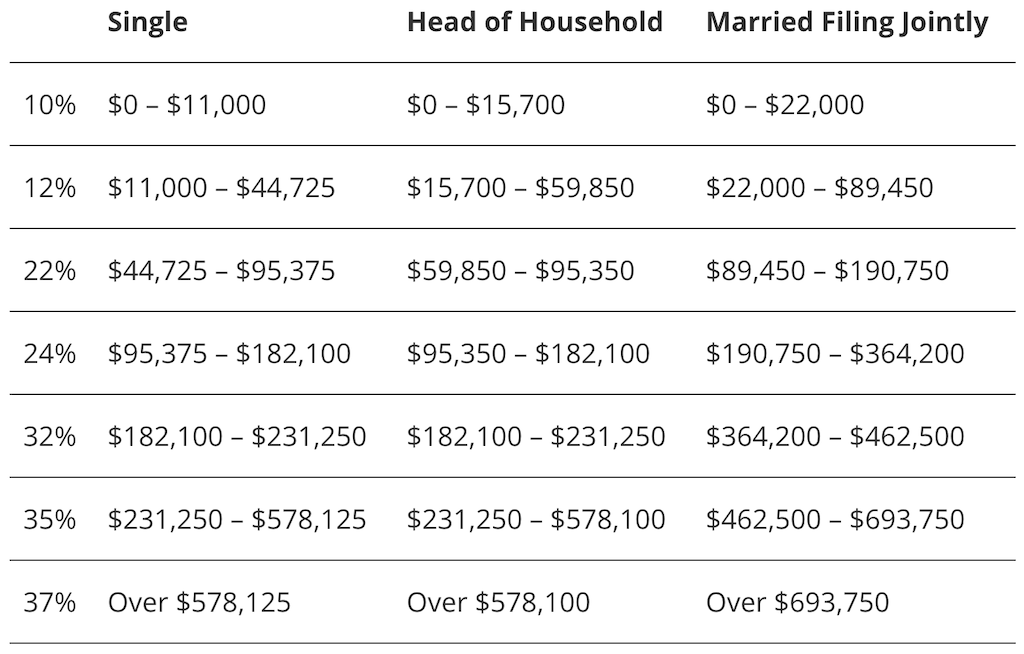

It’s important to remember that federal income taxes are incremental, so however far you are into the next tax bracket, only that amount will be taxed at the higher rate. Here are the latest tax brackets:

Photo: IRS Rev. Proc. 2022-38.

If you’re considering itemizing, here are the most common tax deductions to keep in mind:

Yes, donations through GlobalGiving may be tax deductible because GlobalGiving is a registered 501(c)(3) organization. Our EIN for tax purposes is 30‑0108263.

Yes, benefits vary.

In addition to tax-deductible donations made by check, online at GlobalGiving.org, or wire transfer, you might be interested in benefits associated with gifts of stock and qualified charitable contributions. With gifts of stock, US taxpayers may be able to receive a charitable income tax deduction for the full fair market value of the stock and avoid capital gains tax. That means your gift can be up to 20% larger than if you were to sell stock and donate cash. Learn more about gifts of stock.

If you are 70 1⁄2 or older, US taxpayers might be interested in qualified charitable distributions. You can make gifts up to $100,000 each year directly from your IRA and, in many cases, avoid paying income tax on that distribution. Plus, qualified charitable distributions can count toward your Required Minimum Distribution. Learn more about qualified charitable contributions. GlobalGiving also accepts gifts through donor-advised funds.

GlobalGiving is also a registered Charity in the UK under charity number 1122823. If you are a UK taxpayer, your donation will allow us to claim Gift Aid on your donation, equating to an additional £0.25 for every £1 donated.

If you are an individual or corporate donor based in Belgium, Bulgaria, France, Germany, Greece, Hungary, Italy, Spain, or Switzerland, you are also able to make an online donation to GlobalGiving UK through the Transnational Giving Europe platform. This mechanism allows donors to claim tax-efficient benefits in-country when making the cross border donation. If you are a donor based in France or Germany and wish to make an off-line donation to GlobalGiving UK, you can also make your donation through Transnational Giving Europe and claim in-country tax benefits.

Whether or not tax benefits are a factor in your giving, we’re thrilled it’s on your mind. This is the most common time of year for giving back, and your generosity can move forward your favorite causes before the new year.

Want to learn more? Check out our articles on tax-smart giving.

Featured Photo: Help pay teachers during political unrest in Haiti by Friends of EIM, IncFind exactly what you're looking for in our Learn Library by searching for specific words or phrases related to the content you need.