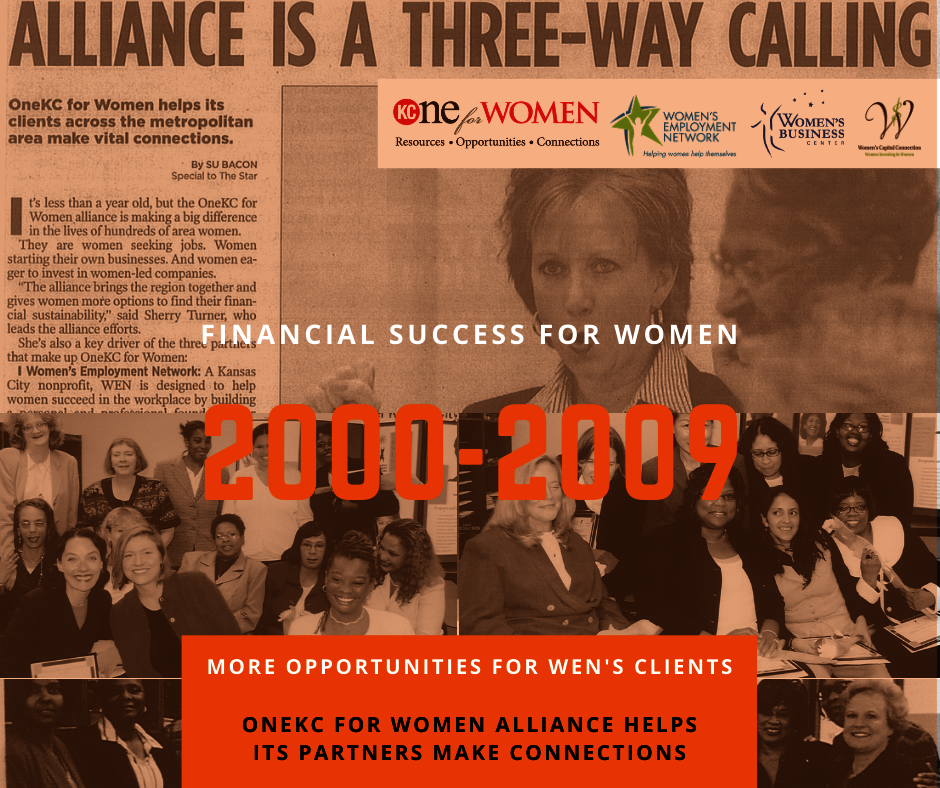

The Women's Employment Network (WEN) was founded in 1986 to assist women in raising their self-esteem and achieving economic independence through sustained employment. Our vision is to advance positive change in the lives of women, their families, and the community, one woman at a time.

Each of GlobalGiving’s nonprofit partners is required to send quarterly donor reports detailing the impact of their work. Here are some of their recent updates:

By Erin Cole | Chief Development Officer

When you support Women’s Employment Network (WEN), you support connection for women. Here, women build rapport with our staff and with one another, forming valuable and lasting social and... Read the full report ›By Erin Cole | Chief Development Officer

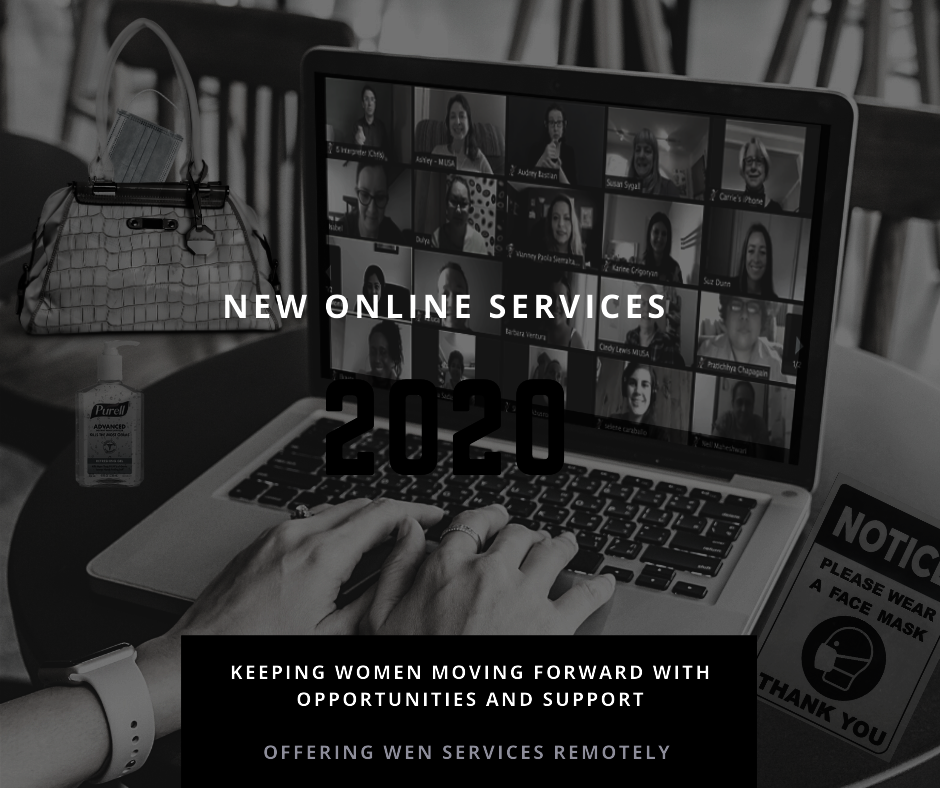

When you support WEN, you help provide an accessible on-ramp to livable-wage jobs and long-term financial stability for Kansas City women. Building upon the success of the new Three Pillars to Success... Read the full report ›By Erin Cole | Chief Development Officer

When you support Women’s Employment Network (WEN), you support connection for women. Here, women build rapport with our staff and with one another, forming valuable and lasting social and... Read the full report ›